Reps. Suozzi and Gillen, Northwell CEO Dowling and Community Leaders Warn of Harmful Impact from Budget Bill

Image

May 28, 2025

Bill would callously cut Medicaid, give needless tax cuts to the wealthiest, and blow the biggest deficit we’ve ever had

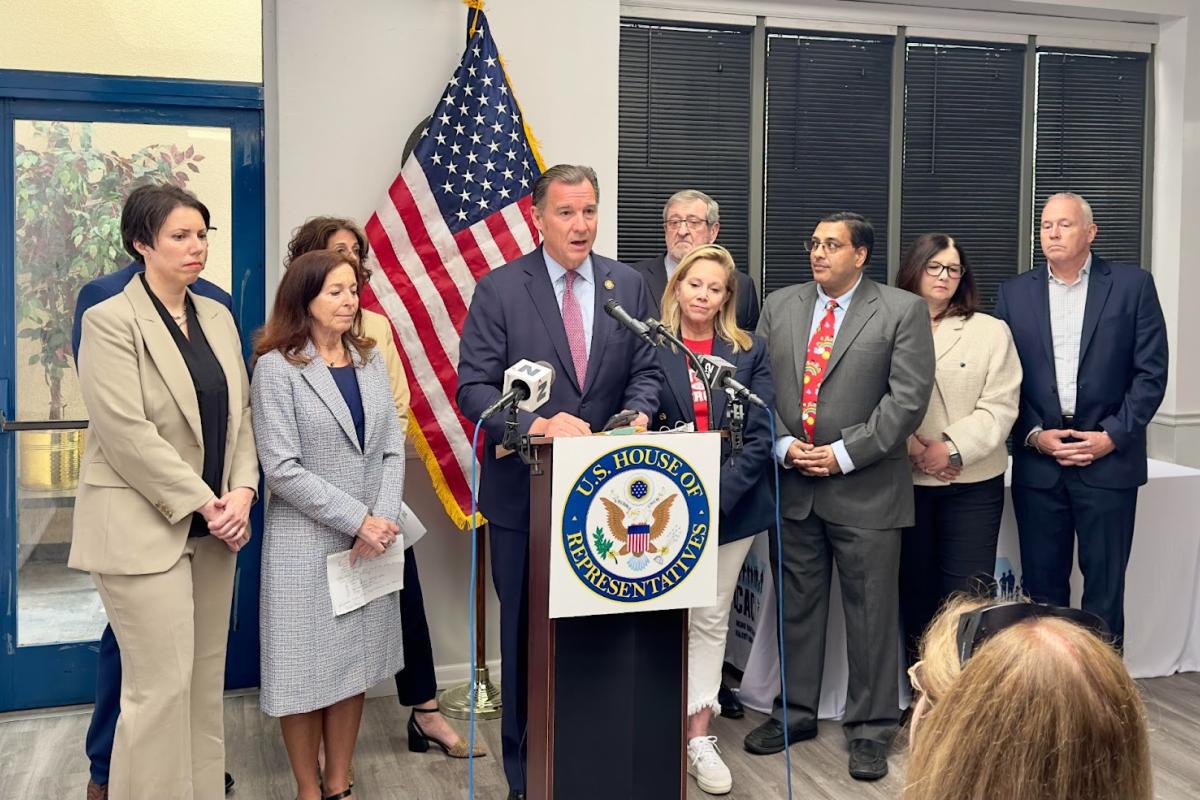

Glen Cove, NY - Today, Representatives Tom Suozzi (NY-03) and Laura Gillen (NY-04) gathered together Northwell CEO Michael Dowling and other local community leaders at a press conference to address the potentially harmful effects of cutting Medicaid, needless tax cuts for the wealthiest people in America, and blowing the biggest deficit we’ve ever had in the recently passed House budget reconciliation bill. Video of the press conference can be found here.

The Congressional Budget Office estimates that this bill will add more than $3.3 billion to the national debt over the next ten years. Even Elon Musk said he “was disappointed to see the massive spending bill, which increases the budget deficit, not decreases it… I think a bill can be big, or it can be beautiful. But I don’t know if it could be both.”

“I have serious concerns about the reconciliation and budget plan for several reasons,” said Rep. Suozzi. “Most notably, the package includes callous cuts to Medicaid, SNAP, and other vital programs that support hospitals, nursing homes, and children's care centers. These cuts will significantly undermine the delivery of healthcare services, putting access and quality of care at risk for everyone.”

“Additionally, the reconciliation package expands tax cuts for the wealthiest Americans—those who need them the least,” Suozzi continued. “While implementing these deep and harmful cuts, the budget plan also adds significantly to the national deficit.”

“When Medicaid cuts go through, they're going to increase premiums for people with private insurance,” said Rep. Gillen. “This is going to impact everyone. When we see health care costs go up, people are going to stop spending money on food. Parents are going to say ‘I don't need to eat tonight because I have to pay for my child's prescription.’ And when they go to places like Island Harvest, they're going to come up short because of the devastating cuts that have been made to the SNAP program.”

Northwell Health CEO Michael Dowling emphasized how these cuts will impact both his hospital network as well as the number of people in New York who will lose their insurance. “This bill will reduce our [Northwell Health’s] revenue by about $370 million,” said Dowling. “About 1.5 million people in New York will not be eligible for Medicaid anymore. The total impact on New York in general will be about $13.5 billion.” Dowling also emphasized that budgets reflect what we believe in. If you believe in caring for others and going forward, this budget is the opposite.

Wendy Darwell, President and CEO of Suburban Hospital Alliance of New York State was quick to highlight how large these cuts really are. “The numbers here for healthcare are staggering. There’s a trillion dollars in healthcare cuts overall,” said Darwell. “There will be a $150 million cut a year to hospitals in Nassau and Suffolk counties before the state responds. It’s not going to be possible for New York state to absorb a $13.5 billion hit without making cuts to benefits, to eligibility or to providers, probably some combination of the three. You may think these cuts will hit someone else. They hit everybody.”

Dr. Jeffrey Reynolds, President and CEO of Family and Children’s Association spoke about mental health struggles, particularly in young adults. “It’s no secret that this country, this state, and our Island has struggled under the weight of a mental health crisis since COVID,” said Dr. Reynolds. “We know that one in four adults has demonstrated symptoms of anxiety and depression. We know that when it comes to kids, it’s closer to one in three. We know that all the data we look at now says that one in six kids have contemplated suicide… the single largest payer for children’s mental health care is Medicaid…Now is not the time to rip the rug out from these families.”

At the press conference held at the Levittown Community Action Coalition’s YES Community Center, Representatives Suozzi and Gillen were joined by several distinguished community leaders. These included Michael Dowling, CEO of Northwell Health, Dr. Jeffrey Reynolds, President and CEO, Family and Children's Association, Adrienne Esposito, Executive Director of Citizens Campaign for the Environment, Randi Shubin Dresner, President and CEO of Island Harvest, Nicole Zerillo, Director of Strategic Communications of AHRC Nassau, Larry Lamendola, Co-Chair of Levittown Community Action Coalition, Dr. Shetal Shah, Past President of American Academy of Pediatrics NY Chapter 2, and Wendy Darwell, President and CEO of Suburban Hospital Alliance of New York State.

The proposed healthcare cuts in the House-passed reconciliation package represent the largest cut to hospitals and healthcare providers in history. The bill eliminates health coverage for at least 13.7 million Americans, including 1.5 million New Yorkers. It raises costs for consumers, shifts costs to states and cuts payments to providers, and makes it harder for people to get and keep affordable health coverage.

Nearly 7 million New Yorkers benefit from Medicaid. New York State estimates these changes will cost New York $13.4B per year. NYS currently spends $35.5B per year in state dollars on Medicaid.

Hospital losses in NYS will exceed $1.3B annually due to an increase in uncompensated care and reduced reimbursements. According to the Fiscal Policy Institute, Long Island will lose almost 30,000 jobs as a result.

Even conservative Senator Josh Hawley (R-MO) opposed the cuts: “If Congress cuts funding for Medicaid benefits, Missouri workers and their children will lose their health care. And hospitals will close. It’s that simple. And that pattern will be replicated in states across the country.”

The bill makes these cuts in the pursuit of tax cuts for the wealthiest. People making more than $1 million per year would have an average tax cut of almost $90,000. The top 5% would receive almost half of the total tax cuts.

###